|

Energy Storage

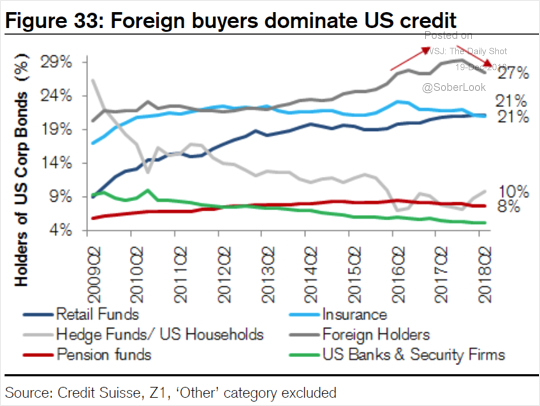

$26 MM equity funding for energy storage involving salt and rocks. Oil & Gas Oil prices continue to fall and gas prices rise. WTI lost 40% of its value in 4 years. Latest News Fed raised rates by 25 bps to a range between 2.25% and 2.5%. Fed cut its projections for 2019 from 3 rate hikes to 2. Unemployment is still at its lowest level since 1969. Fed lowered forecast on growth. Investment-grade rated sponsors are paying UST + 1.4% up from UST + 1%in 2017. Below investment grade sponsors are paying UST + 4.5%, up from 3.2% PE 1-year rolling IRR 18.9%. VC net cash flow $36.3 BN. HNW focus on impact investing as a means to achieve social and economic goals. Family offices control $4 TN of assets, that is more than hedge funds and equivalent to 6% of the value of the world's stock markets. Indicative PE term sheet. $15/ton carbon tax not expected to be approved. Real risk of a credit bubble. PE raised a record of nearly $750 BN globally in 2017. Textbook M&A transaction. Acquisition, add-ons, and IPO within 5 years. Investment in sustainable business can lead to better results.

0 Comments

Leave a Reply. |

Archives

February 2019

|