|

Solar PV & Wind

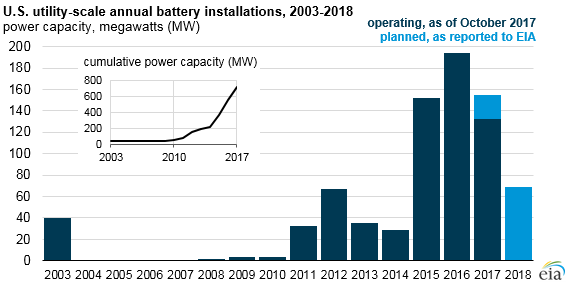

MA competitive auction price cap $0.17/kWh. Bid prices expected to be 30-40% below the ceiling. 400 MW in queue for the SREC II incentive program. Must be complete by March 31, 2018. Very low PPA prices for wind and solar plus storage: (1) Solar + Storage = $36/MWh (2) Wind + Storage = $21/MWh 2014 RFP 430 proposals for 238 projects representing 112 GW. Wind and solar 358 bids representing 101 GW. 2013 RFP 55 proposals. Results: (1) Wind - $18.10/MWh. 42 GW bids, 17 GW awarded (2) Wind + Solar - $19.90/MWh (3) Battery storage - $21/MWh (4) Solar - $29.50/MWh. 30 GW bid, 13 GW awarded. 152 proposals for 75 projects. (5) Wind + Solar + Battery Storage - $30.60/MWh. (6) Solar + Storage - 87 bids, 59 projects. Thermal Power Thermal power projects at the mercy of gas prices. In future, renewables might have a detrimental effect on thermal power. FERC rejects "90-day' rule. Energy Storage 500 MW energy storage installed in the US in 3 years. 29% in CA. Utilities and IPPs targeting frequency regulation. Utilities also targeting peak shaving, ramping support, provision of reactive power and backup power. Solar + Storage expected to increase energy output up to 50%. Energy storage market could reach $100 BN by 2030. Energy storage popular business model outside the US. Integrating energy storage with wind and solar occurring inside the US. Oil & Gas Oil prices expected to remain low. Industry will focus on how to generate cash, reduce costs, limit investments in oil and gas, and diversify. Latest News 2017 annual funding $70 BN up 16% but number of deals down 4%. China largest investor in clean energy at $44 BN, US is 2nd. Energy trends for 2018:

(1) Repeal of the corporate AMT (2) 30% cap on deducting interest. (3) Tax rates for corporations fall from 35% to 21% (4) Sales of state credits increase the net yield from 65 cents to 79 cents.

0 Comments

Leave a Reply. |

Archives

February 2019

|