|

Wind

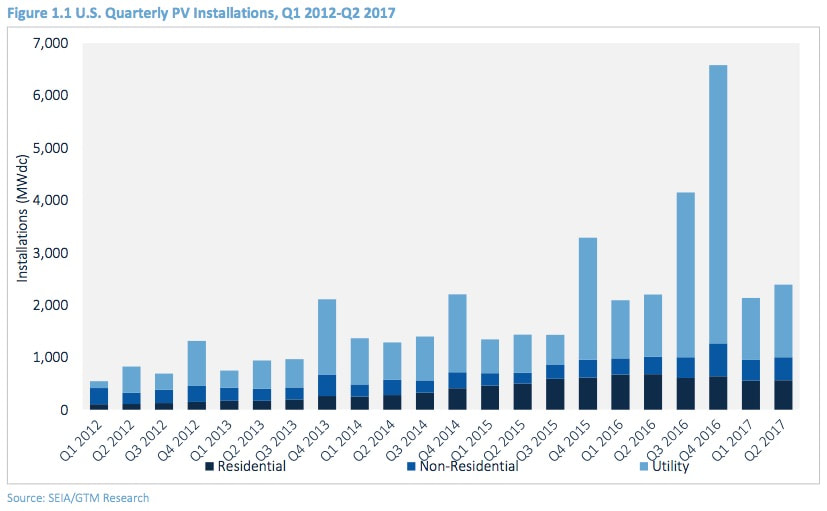

Renewables cheaper than conventional power. Offshore wind cheaper than nuclear for the first time. 5.75 p/W vs 9.25 p/W. Offshore wind sector alone will invest £17.5 BN in the UK up to 2021. NEE raised $300 MM to acquire renewable assets either from NextEra Energy Resources or third parties. Solar PV Infrastructure-as-a-Service. Generate Capital to install Sharp solar PV + storage at 6 CA schools. Corporate PPAs for renewables. Anheuser Busch PPA with Enel goal of 100% renewables by 2025. Tenaska engaged Kroll to provide rating for private placement to finance 400 MW Imperial Solar West solar PV power project located in CA. Equity markets attractive for liquidity event. Blackstone preparing for sale or IPO of Vivent. Values company at $6 BN including debt. Comparables (i) Qualcomm acquired NXP for $40 BN and (ii) Apollo bought ADT for $7 BN, preparing an IPO for $15 BN. CapDyn acquires 28 MW solar PV power projects located in CA from Solar Frontier. NTP-ready and PPAs with PG&E. 2Q17 largest 2nd quarter installations on record at 2.4 GW. 22% of US new generation. Expect 16 GW/year by 2022, a 3x increase over 5 years. Installed cost solar PV < $1/W. 31 states will be below grid parity by 2018. 2/3rd utility PV pipeline comes from projects procured outside RPS, driven by cost-competitiveness with natural gas. Panda Green Energy 24 MW solar PV project located in NC. 15-year PPA. Thermal Power 8.5 MW biomass power project located in ME. 20-year PPA with CMP @ 9.9c/kWh. IL energy law reform allows energy efficiency to be rate based and generate a guarantee rate of return for utilities. Data Center approved in AL to encourage $1 BN new investment. Located adjacent to 758 MW Panda Sherman Power Plant. Oil & Gas Pipelines proposed and open seasons to export stranded gas. Transport 600 MMcg/d natural gas from CO DJ Basin to Wyoming and Cheyenne Hub. Energy majors divesting traditional assets. BP IPO midstream O&G MLP. Shell, Valero, Tesoro and Marathon have arranged similar structures. UK and France both plan to end sale of petrol and diesel cars by 2040. EVs would increase from 1% of global car sales today to 10% by 2025 and up to 30% by 2035. EVs to reach cost parity with internal combustion engine cars by 2022 Latest News Market fundamentally strong for the remainder of 2017. Inflation expectations at a record low. Financial conditions continue to ease. More economists now think the Fed is done with rate hikes for the year. Market might correct in 2018 if rates rise. "Uber for trash" received $50 MM from Promecap valuing the company at $1 BN. Equity also from GS and Engie. Apollo raised $24.7 BN. Silver Lake raised $15 BN. KKR raised $13.9 BN. Bain Fund XII raised $9.4 BN, Fund XI $10 BN earned 9.2%. Bain offers to buy Toshiba chip business for $19 BN. FDA approval for recycled plastics use in food packaging. In most cases approval "up to 100%" recycled plastic. Increased support to repeal PURPA. Last vestige of an energy market reform that "may have run out of purpose". Tax equity market update: (1) Tax equity investors - 45 investors (2) Tax equity market - 2016 $11 BN, 2015 $13 BN, 2014$10 BN, 2013 $6.5 BN (3) Merchant projects - Involving financial hedges are mostly partnership flip.

0 Comments

Leave a Reply. |

Archives

February 2019

|