|

Wind & Solar PV

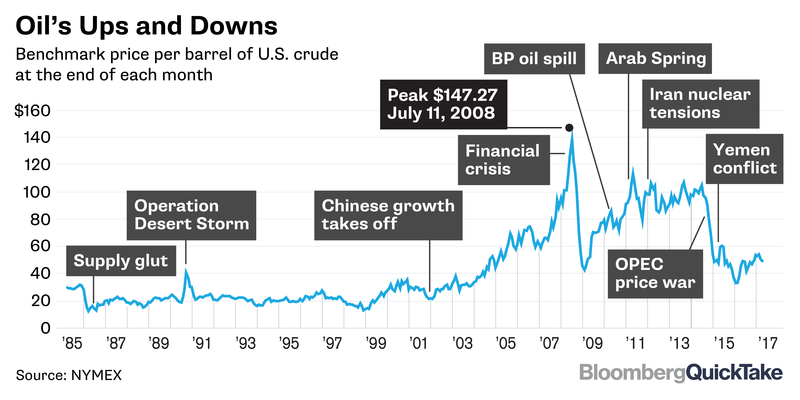

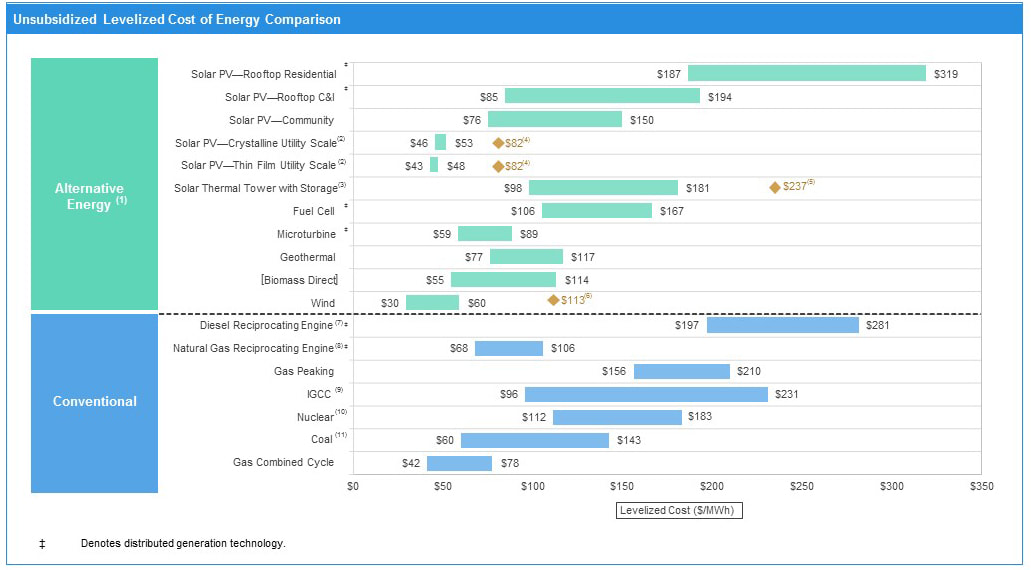

Cypress Creek sells 14 solar PV power projects located in NC and CA representing 130 MW to New Energy Solar of Australia. 10 projects representing 71 MW located in NC sell power to Duke Energy Progress. New Energy Solar IPO in Australia expected to raise $100-300 MM. Gross portfolio returns 7-10%. Cypress Creek invested in SC $1.5 BN in 80 solar projects totaling 2 GW. It supports PURPA legislation that has been enforced in only about 1/3rd of states. Solar PPA prices in CA have fallen by 77% from 2008 to 2016. CPUC plans to procure 33% of retail sales/year from renewables by 2020 and 50% by 2030. Acciona 132 MW Mount Gellibrand wind power project located in Australia secures $57 MM term loan from ICO, Spain state owned bank. Expected online 2018. Power sold to the Australian wholesale power market. 66 MW of RECs sold to the Victorian government over 10 years. Acciona has about 335 MW of wind power in Australia. Enel PPAs for 4 wind power projects located in Mexico representing 593 MW. ConEd buys 25 MW Big Timber wind power project from Baywa. TerraForm sale to Brookfield yields $417 MM gain to SUNE. Had targeted ROI 12% and dividend growth rate 5-8%. Thermal Energy NTE $500 MM Reidsville Energy 500 MW CCGT located in NC expected online 2021. Expected to be merchant. NTE $440 MM Kings Mountain 475 MW CCGT located in NC expected online 2019. PPA counterparties not known. Xcel Energy plans to close 3 biomass power projects located in the Midwest. According to the utility, biomass power costs 10x more than wind. Removing biomass energy could save customers nearly $700 MM over 11 years. Xcel Energy will create a $54 MM renewable energy development fund. Iberdrola closing worldwide its 2 GW fleet of coal-fired power projects. Targets reduce CO2 emissions intensity by 50% in 2030 (from 2007 levels). EDP, Enel, Iberdrola and SSE, among others, urge EU to adopt 35% renewables by 2030. Oil & Gas Oil prices remain subject to market supply and demand. Supply impacted by fracking, demand electrification. OPEC and its allies will extend supply curbs through the end of 2018. OPEC’s game theory dilemma. Anatomy of oil prices. Kinder Morgan Sabine Pass $151 MM Train 5 600,000 Dt/d 20-year gas supply agreement. Magnolia LNG approved but still seeking contracts. SNC-Lavalin (rated BBB) 3-year $600 MM credit facility @ 2.689%. Existing credit facility @ 6.19%. Total announces almost 30% increase in operating income, acquires 23% interest in EREN Renewable Energy. Natural gas oversupply might keep prices down. Gulf coast pipelines near capacity. Natural gas prices at Waha down $0.57/MMBtu or about 20% below Henry Hub. Analysts forecast the gap exceeding $1/MMBtu next year. COP creates energy price cap for new O&G investment of $50/bbl. It will invest $5.5 BN in projects. Target 20% CROCE by 2020. Target average $40/bbl. Harbour Energy, venture of EIG and Noble, $11 BN bid for Santos #2 Australia energy company. Oil production prices $32/bbl, brent $50-55/bbl. $19 BN PNG LNG, $18.5 BN Gladstone LNG. Latest News US expected growth 2.5%, unemployment 3.7% and might be 3.5% in 2019. Inflation expected to be 1.8% in 2018. Market expects rate increases in 2018. 7 energy majors have committed to cut methane emissions from natural gas. 76 MM tons/year of methane are emitted from global oil and gas operations. Tax equity accounts currently for 50-60% of the capital cost of a typical wind farm and 40-50% of the capital cost of a typical solar installation. US tax bill intention is to protect against cross border payments that reduce taxes. Might create an uncertain environment for investment and lead to clawback on past investments. UK expects 1.6 MM electric vehicles by 2020. Represents 200-550 MW of turn-up capacity, 400-1,300 MW turn-down. Expects 11 GW EV capacity by 2030 and 9 MM EVs representing 3 GW turn-up capacity and 8GW turn-down. China Power, world's largest energy company, has invested $250 BN in the US. It will invest $83 BN in WV O&G and chemicals businesses. Fulcrum Waste-to-Fuels company raises $46 MM equity from 9 investors. It has raised $300 MM equity to date. Fulcrum focuses on developing biofuels specifically for aviation. $280 MM project 1 expected online by 2020 will process 175,000 TPY MSW to 10.5 MM GPY of biofuels. SalMar has committed $300 MM to 6 R&D facilities that can produce 1.5 MM fish in 14 months. Indonesia is pushing ahead deep offshore farming. US approved in 2016 offshore fish farming in federal waters 3 miles offshore. World output of wild-caught fish could be farmed in 0.015% of the ocean surface area (about the size of Lake Michigan). Global food production will need to increase 70% by 2050. Middlebury College and Vermont Gas purchase gas from largest AD to Gas project located in VT. Developers Vanguard Renewables and Cabot. Project will process 100 TPD of manure and 165 TPD organic food waste. It will produce 140 Mcf/year of RNG, 100,000 Mcf/year to Middlebury and 40 Mcf/year to Vermont Gas. States plan to reduce CO2 emissions by 30% between 2020 and 2030. New York Green Bank will raise another $1 BN in private sector funds. NYPA $300 MM annual investments in EE and solar through 2020. Signed 27 EE customer project commitments representing investment of $158 MM. Completed EE projects representing investment of $81.5 MM. 277,000 MMBTU energy savings, 25,000 tons of GHG emissions reduction. Plan to reduce annual carbon emissions 60% by 2050. 27 auto and energy firms promote hydrogen as a fuel. Expect 12 cars powered by hydrogen by 2030. China 1 MM hydrogen fuel cell cars by 2030. Britain $30 MM fund to accelerate the take-up of hydrogen vehicles. Investment of $280 BN by 2030. $110 BN to fund hydrogen output. $80 BN for storage, transport and distribution, and $70 BN to develop products. Hydrogen market annual revenues of $2.5 TN. Immingham 50 MW £170m EfW project located in the UK. 600,000 TPY waste converted as follows: (1) Recycled and (2) 50% converted to RDF. Photobioreactor converts emissions from thermal power projects into fertilizer by grower algae. 50% renewables possible in Australia without storage but not economic. $36.5 BN for pumped hydro and batteries needed to make the national grid secure and reliable if 75% of power was from renewables.

0 Comments

Wind and Solar

|

Archives

February 2019

|